When you are approved for a mortgage, your lender will typically offer you mortgage insurance. That may seem convenient, but before you say yes to mortgage insurance, you should know that you have other options.

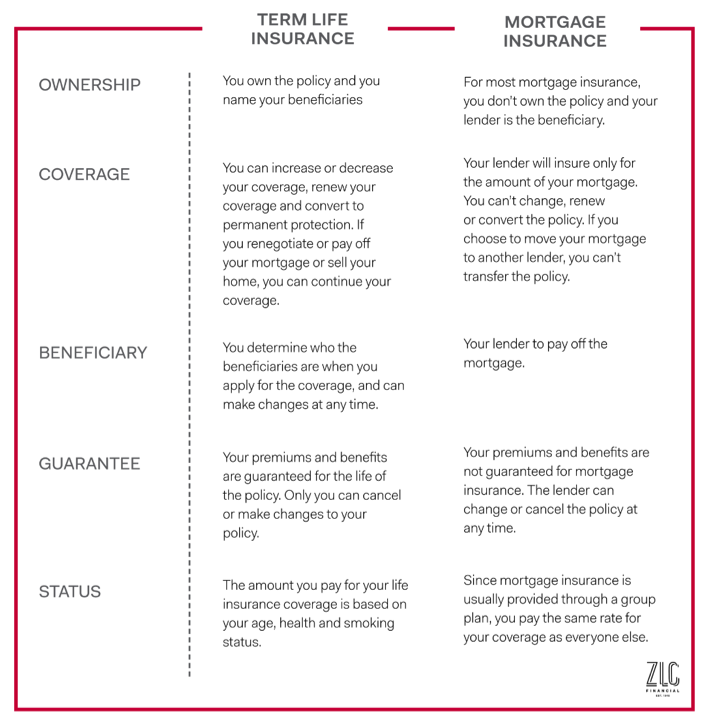

Term insurance is an option that is rarely offered by a lender, but it can do far better in most circumstances. Protecting your mortgage with an individually owned term insurance plan offers better value and more flexibility.

In addition to the factors mentioned above, it’s also important to highlight that mortgage insurance coverage ends when your home is paid off. A personal life insurance policy is unaffected by your mortgage being paid off and can keep providing you and your family with protection in the years that follow.

In the same way that you decided to use an independent mortgage broker to help secure your customized home financing solution, it’s ideal that you work with a financial advisor to help you find a suitable insurance solution to protect your family. An independent insurance broker can work with you to find the coverage that works for you.

Also, keep in mind that it’s important to consider critical illness insurance in case you become seriously ill or injured and unable to pay your mortgage and other expenses. If you are an employee, your employers may offer critical illness as a benefit for you, but be sure the coverage is sufficient for your needs.

Because everyone’s circumstances are unique, it is important to review your particular needs with a qualified associate.

Philip Levinson and Brent Davis are associates with ZLC Financial.