Incorporating charitable giving into our lives is not just a philanthropic act; it’s a value deeply ingrained in Jewish tradition. With recent events underscoring the importance of such contributions, it is prudent to explore various giving strategies available in Canada.

Cash Donations

One of the most common ways to give is through cash donations. This straightforward method allows organizations to use the funds to further their operations, while offering valuable tax savings to donors.

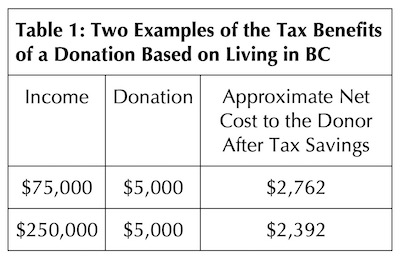

Cash donations to registered charities provide a tax credit both provincially and federally. The tax benefits of the donation are based on the donation amount and the marginal tax rate. To keep things simple, Table 1 shows two examples based on living in British Columbia.

Cash donations to registered charities provide a tax credit both provincially and federally. The tax benefits of the donation are based on the donation amount and the marginal tax rate. To keep things simple, Table 1 shows two examples based on living in British Columbia.

In-Kind Donations

Non-cash donations are equally essential for charities, depending on the services and programs they offer. These contributions encompass tangible goods or services, such as clothing, food, furniture, books and medical supplies. Much like cash donations, in-kind donations can make donors eligible for a tax deduction. The value is determined based on the fair market value of the donated goods and services.

In-kind donations in the form of securities or stocks offer a popular and tax-advantageous way to contribute to charitable causes. To qualify for these favourable tax benefits, the donated securities must be listed on a designated stock exchange in Canada. Generally, publicly traded stocks and certain mutual funds meet this eligibility criterion.

The value of the donation is determined by the fair market value of the securities at the time of the donation. An important feature of this method is that the donation itself is exempt from capital gains tax on any accrued capital gains. This means that, if your securities have appreciated in value since you acquired them, you can donate them without incurring capital gains tax on the increase in value.

There is a limitation to consider: you can claim donations of securities for up to 75% of your net income in the year you make the donation. However, any donations exceeding this limit can be carried forward for up to five years. This flexibility allows you to maximize the tax benefits over time, ensuring that your charitable giving aligns with your financial situation.

Donor-Advised Funds

One powerful strategy for charitable giving that warrants further exploration is the use of donor-advised funds through a CRA-registered foundation such as the ZLC Foundation or the Jewish Community Foundation. These funds provide a structured and effective approach to managing and maximizing your philanthropic endeavours, making them an excellent choice for those interested in creating an endowment. By establishing a donor-advised fund, you can exercise a greater level of control and intentionality in your charitable contributions, ensuring that your giving aligns with your values and long-term goals.

Life Insurance

Using life insurance policies to contribute to a charitable organization offers a meaningful way to leave a legacy. While this method differs from the others discussed here, it provides a substantial, long-term benefit. Life insurance policies can be set up to benefit a charity in several ways:

- Donating a policy. You designate the charity as the beneficiary while continuing to pay the premiums. Upon your passing, the charity receives the death benefit, and your estate may be eligible for a charitable donation tax credit.

- Purchasing a new policy. The charity becomes the revocable beneficiary, receiving the same benefits as in the previous option. You can also transfer ownership to the charity, allowing premium payments to receive tax benefits while you’re alive.

- Donating dividends and interest. For whole life policies, you can redirect dividends to cash, which can then be donated to the charity of your choice.

- Canada Life My Par Gift. Canada Life recently introduced an innovative participating life insurance product designed for charitable giving. Here’s how it works:

- A one-time premium payment by the donor.

- The charity owns and is the beneficiary of the policy, issuing a tax receipt to the donor for the premium paid.

- This policy, unique to participating life insurance, offers potential dividends, flexibility in dividend options, and cash value growth without tax implications.

- In the event of the insured’s passing, the charity directly receives the payout. Canada Life My Par Gift policies are exclusively owned by registered Canadian charities, providing a simplified and impactful way to make a significant charitable contribution.

This array of giving strategies not only empowers individuals and organizations to make a difference but also reinforces the values that are central to Judaism. The power of giving back is one of our most enduring strengths, allowing us to face challenges with compassion and purpose.

Philip Levinson, CPA, CA, and Brent Davis are associates at ZLC Financial, a boutique financial services firm that has served the Vancouver community for more than 70 years. Each individual’s needs are unique and warrant a customized solution. Should you have any questions about the information in this article, visit zlc.net or call 604-688-7208.

Disclaimer: This information is not to be construed as investment, legal, taxation or account advice, nor as an offer to sell or the solicitation of an offer to buy any securities. It is designed only to educate and inform you of strategies and products currently available. The views expressed in this commentary are those of the authors alone and are not necessarily those of ZLC Financial or Monarch Wealth Corp. As each situation is different, please seek advice based on your specific circumstance.